What if you could get up to $25,000 for your home pick just as a first responder, firefighter, police officer, or armed forces group? Well, you can now! It might help if you satisfied particular Home town Heroes Mortgage System conditions. For instance, your to shop tax refund cash advance emergency loans 2022 for family have to be in Lime County, Florida.

Of many earliest-date homebuyers do not think that they may qualify for a loan by themselves because they don’t are able to afford secured to possess an advance payment otherwise as they keeps less than perfect credit from early in the day problems in life instance entering personal debt or which have a beneficial negative credit report due to later money or even bankruptcy facts. However, there are possibilities to very first-go out homebuyers which have money lower than 80% AMI which can not have started felt prior to now while they believe they would not be able to be eligible for that loan with the their unique.

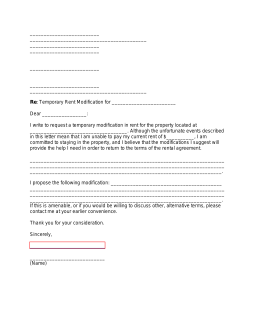

Hometown Heroes Mortgage System

Did you know about the Home town Heroes Financing System, a program for people on the military and you may very first responders, such as cops and you will flames, medics, as well as educators? Good news! Which mortgage system has started to become for sale in Main Florida.

The newest Hometown Heroes Mortgage program is for members of the brand new armed forces and you can first responders, including police and you can flames, medics, and also instructors. This new loans are designed to aid these heroes get land into the Main Florida.

You don’t need to spend any cash back if for example the application is eligible! Incase it is far from acknowledged, there’s absolutely no harm over – zero credit history was influenced by applying.

Exactly what when the I am not saying eligible?

Unfortunately, this isn’t offered to anyone: just those that are certified below Label 38 can put on (so there are lots of certification).

Survivors using inside 2 yrs after the loss of a life mate otherwise lesser son on account of death while carrying out army provider financial obligation

Retired service participants receiving retirement spend at the least fifty% disability rating or similar fee reliant the size of services rendered

- Medical professionals

- Nurses

- Educators

$twenty-five,one hundred thousand to your home get

The fresh Hometown Heroes Base will provide earliest responders, pros, and other hero pros $twenty five,100 to invest in their houses. In most cases, zero down payment will become necessary. There are even zero monthly obligations otherwise focus repayments needed to your loans. The only requisite is that you reside in the home to possess at the very least eight many years just after closing.

The program performs such as this

You might select any household into the Fl one to will set you back below the most number set for as long as it fits HUD recommendations (see “Home town Heroes System Standards” below).

The Hometown Heroes Base will provide you with an offer out-of up so you’re able to $25k on the buying your new house. Suppose your loan arrives in order to less than what the Hometown Heroes Basis needs (it ought to be according to comparable sales analysis from inside 29 kilometers off what your location is buying the assets). If that’s the case, they will increase their bring accordingly up until their maximum amount might have been achieved.

Thus even if there isn’t adequate guarantee remaining right after paying regarding one liens against the domestic immediately after to acquire they (if the discover any), they’re going to however give us sufficient currency for us without having had something come-out yet!

Real rebates

Brand new Home town Heroes system is not that loan. It is a primary dollars promotion and you may discounts system which you can put on to your home pick otherwise re-finance settlement costs.

Hometown Heroes is a national company away from real estate properties having hitched having tens of thousands of regional real estate agents into the just about every condition and you may state over the U.S to include valuable discounts on a property fees.