step 3. Fill in your application

Once you’ve talked so you can a loan provider that you find safe performing which have, you could submit a proper application having a great HELOC.

Based on how much you want to to help you acquire and your mutual loan-to-worthy of proportion, the applying could well be lighter to your paperwork. Such as for example, for those who have plenty of collateral in your home and you are clearly not looking to obtain almost everything, the lending company you will allow you to skip property assessment, which will make the application and you can closure process faster and easier.

cuatro. Close with the loan

There isn’t far more you should do when you fill in the application. The lending company will glance at your documents and you will, if all the goes really, offer you brand new HELOC. After that, it will require anywhere between 30 and 60 days to shut to the the loan and also have your bank account.

Criteria to try to get good (HELOC)

The applying having an excellent HELOC, just like a mortgage, means certain official certification on borrower and certain records to https://paydayloansconnecticut.com/candlewood-shores/ show it. Here are the conditions toward borrower:

- Good credit. Mazzara and Vaughan claim that a favorable credit rating is normally from the 700s, and also the higher the greater. Your credit score does not only apply at your rate of interest, as well as whether the financial will provide you with an effective HELOC from the all the.

- A reliable money. Loan providers need to make sure possible remain with the monthly payments away from a beneficial HELOC, so that they will demand that you have a very good money that’s well-noted.

- An acceptable financial obligation-to-income (DTI) ratio. It requirements differ because of the lender, however, they’re going to usually like to see a reduced personal debt-to-income ratio – so your monthly loans money are only a small tiny fraction of one’s complete month-to-month earnings. Some other loan providers could have different qualifying DTI rates, but a DTI proportion to try to possess is actually lower than 43% in order to fifty%.

- Enough family equity. Lenders want to make yes you may have enough collateral on the house before permitting their borrow against it. Whether or not requirements will vary of the lender, very loan providers allows a maximum joint financing-to-really worth proportion from 85% – definition you will want to remain about fifteen% security of your property once bookkeeping for your HELOC, top financial, and every other household guarantee money or HELOCs secured by your family.

- Pay stubs. Needed these to illustrate that you keeps a reputable month-to-month earnings that may hold the repayments on your HELOC. Lenders constantly inquire about a couple current spend stubs.

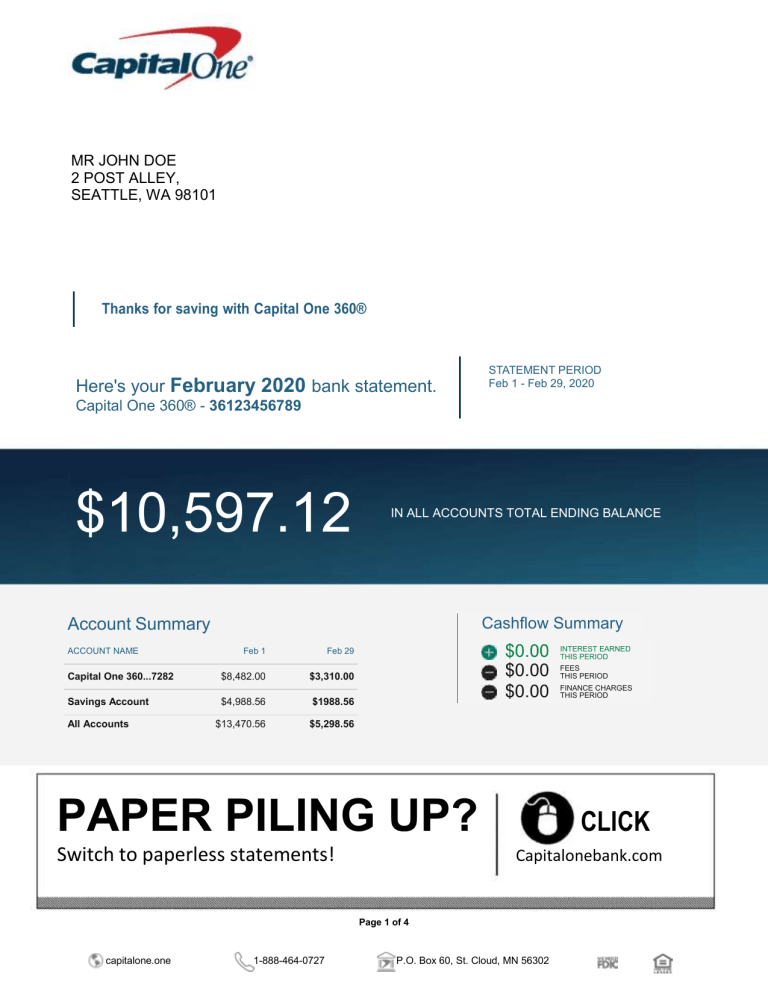

- Bank comments. If you do not currently have the account at the financial you will be using having an excellent HELOC, a loan provider will want to discover statements that show their savings and you can assets.

- Evidence of homeownership and you may insurance. Your own lender may wish to be sure to would be the holder out of the home you’re looking to borrow against.

- Mortgage report. Vaughan says you to definitely loan providers commonly inquire about so it to be certain you happen to be right up-to-go out towards home loan repayments and fees.

HELOC Pricing Are on the rise

The highest rising prices inside the forty years have but really to help you wane. An individual Price Index demonstrated costs up 8.2% year-over-season for the Sep, scarcely an update off August’s 8.3%.

That has ramifications on the Federal Reserve’s services to create rates growth off, but inaddition it setting a great deal for users, specifically those seeking borrow cash. The new Fed will most likely continue to boost its benchmark rate of interest the fresh federal money speed with its lingering bid in order to stem request minimizing inflation. However, one to rate influences the price to borrow money along side savings, including family security personal lines of credit otherwise HELOCs.