If you’re looking from the purchasing otherwise building your first domestic, you happen to be able to get a-one-regarding grant about authorities to assist turn your ideal for the an actuality reduced.

What you’ll learn

- What’s the Earliest Home Owners’ Give?

- That eligible for the initial Home Owners’ Grant

- Simply how much you can get which have an initial Home Owners’ Grant?

- Just how to sign up for a first Home Owners’ Offer

- Additional types of grants available

The initial Family Owners’ Grant (FHOG) are a single-out of commission regarding authorities to help people get or build their first property. Often known as Basic Home buyers Give or Earliest Homebuyers Strategy, this one-away from payment contributes to the newest deposit of one’s acquisition of it first home, when certain conditions is fulfilled. As the system try national, its funded by the separate county governing bodies and given below the respective rules, so varies somewhat by state.

How do i determine if I am entitled to the initial House Owners’ Give?

- Getting over 18 years old

- Be an Australian resident or permanent citizen out-of Australia

- Buy the assets as the a man, less a confidence otherwise company

- Have not possessed property prior to (pertains to all of the candidates)

If you are young than simply 18, you could potentially submit an application for a get older exception, there are other standards which are often waived in certain circumstances, particularly while you are a keen Australian Protection Force member. It is best to inquire on what standards create and do not connect with your position.

Your brand-new home has to satisfy particular conditions, too. Such as for example, new give can not be familiar with get a residential property. The house you order must be very first home around australia and its worth should be only about $one million.

Provided your meet up with the more than conditions, the new grant can be used to make it easier to pick a domestic assets that fits one of many adopting the meanings:

There are other standards that are dependent on the state you happen to be trying to get inside the, for example restrictions towards the cost and/or total well worth of the property or residential property. The original Family bodies website links to each and every nation’s offer criteria, so be sure to check just what speaking of and what you are eligible to.

How much cash could you rating for the Basic Domestic Owners’ Give?

While you are qualified to receive new grant, the newest government and/otherwise state can give you around $10,100 to get to your pick.

Understand that that it number is not each individual or applicant its for every single exchange, property, or bit of vacant property. Therefore a single individual, several otherwise several family would receive around $ten,100, regardless of how the majority are mixed up in acquisition of the property otherwise home.

How-to submit an application for the first Home Owners’ Give

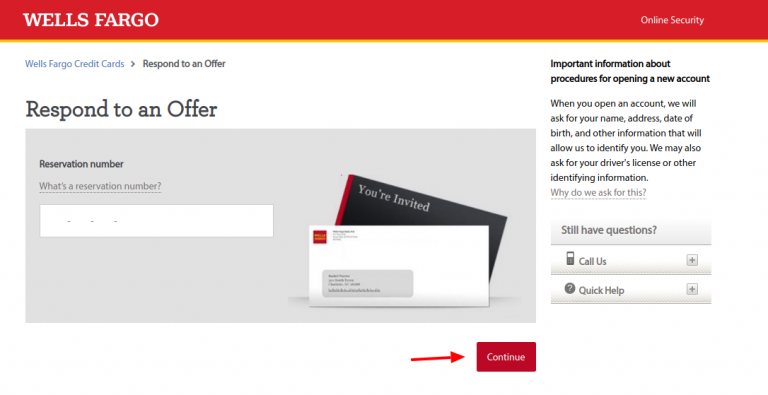

You’ll find more laws and how to get the brand new FHOG based on the County what your location is attempting to purchase. Very first, you’ll need to be sure you while the property otherwise bare homes you would like to pick fit all of the qualifications conditions. You will then need to done a form. A medication broker can help you do this. In a few states, you could query the lending company or standard bank delivering their loans to help you complete and lodge the applying on the part.

You’ll be able to visit us at the regional Westpac part. Our team possess inside the-breadth experience in the local sector and might be more ready to take you step-by-step through the method.

Have there been most other provides available?

Sure, there are many offers that can help you on the trip so you can home ownership. Such will vary county-by-state. By way of example, This new South Wales provides the NSW First Home Buyer Assistance Scheme, and that entitles eligible people to stamp responsibility concessions otherwise exception to this rule of import duty.

The initial Financial Put Design is another bodies plan one to support eligible first homebuyers get a mortgage with only an effective 5% deposit without needing to pay Loan providers Financial Insurance (LMI can be charged so you can consumers which https://clickcashadvance.com/loans/tribal-loans/ have in initial deposit which is smaller than simply 20% of the house value).

The best way to uncover what qualifications criteria connect with both you and your situation would be to both take a look at Basic Family government site, communicate with a mortgage elite, or started come across us on your own regional department.