Carry out a financial investment bundle

Having your investment method straight from big date one gives you the latest most readily useful opportunity during the resource profits. You should understand what assets and you can liabilities you really have, for example a preexisting possessions otherwise any outstanding loans. This can make you a much better comprehension of debt state, and therefore assists you to know very well what a knowledgeable capital potential was for your requirements.

In addition, definitely start by thinking about the reason why you should spend money on the initial put. What do your desire to step out of they? Setting goals centered on what you ought to go make yes your remain on song since your opportunities grow and alter down the road.

Financial support gains otherwise leasing earnings?

Setting-out your aims is also determine which funding approach you’re taking here. In case your point would be to reach overall progress from the money, up coming targeting capital progress, and/or upsurge in your property’s well worth over time, may be the way to go. However, if you’re looking for the capital when planning on taking the form of regular money, you may want to think of leasing out your possessions. Regular contributions from your own tenants can get indicate you won’t need acquire as much causing lower costs.

Going for an investment property

Studies are secret here. Long lasting your investment technique is, the best way to build your capital an emergency is always to buy during the right place and right time. And more than notably, within right price. You need to know not only the location of the property you are considering, nevertheless the related business too. ‘s the area on the rise? Is the demand for rental functions where urban area highest otherwise reduced? ‘s the people set-to improve? Any kind of developments organized that may impression your investment or brand new desirability of your urban area? Talking about all important things to consider, due to the fact each of them will get an effect on the prosperity of disregard the.

Finding the best resource mortgage

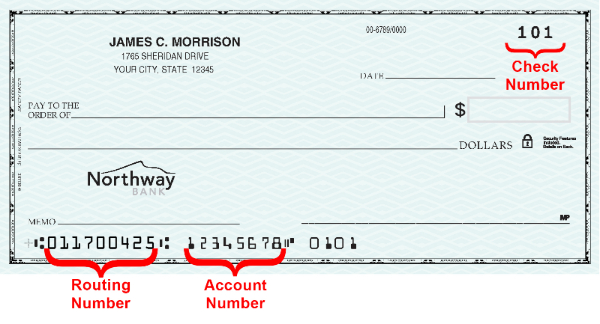

It’s just as essential to find the best financial support mortgage once the its to discover the best mortgage to you https://paydayloanalabama.com/citronelle/ personally. Like your residential financing, you could select from fixed, variable otherwise broke up price financing. You can even make use of flexible keeps particularly redraw and counterbalance levels. Really dealers favor notice merely and personal line of credit fund, but you can consult your local credit expert to go over this new investment financing choices you to best suit you.

Looking for tenants to match you

While committing to a rental property, its also wise to look at the form of tenants you’d like. Looking for a family group, a student, an early partners? You should getting 100% comfy getting them of your house. Oftentimes, the sort of renter your residence pulls was determined by dimensions and place in your home, making it really worth getting the most readily useful renters in the rear of your mind whilst the seeking your property also. The best way to control your rental property is from the finding a representative you never know your area better. They shall be in a position to assist you with ongoing management of the latest possessions and of the latest renters too. It simply is based just how involved we wish to get in the brand new entire process.

After you commit to purchasing, you want to have enough flexibility to enhance their wealth and make use of one opportunities that can come the right path. The second measures can be beneficial:

- Pay attention only on your initial investment financing to release the bucks to help you maximise this new costs for the non-deductible personal debt just like your domestic home loan.

- Repay attention simply just like the an annual share in advance to help you offer forward the tax-deductible appeal costs, and therefore reducing your taxable money.

- Play with loans recycling to create riches making use of the discounts your create on the taxation or income to settle the low-deductible financial obligation basic. This enables you to free up more of your equity.

Increase the income tax benefits

When you put money into a rental possessions, you may be eligible to deduct a variety of expenses from the funding money, then reducing the level of income tax you pay. You happen to be permitted subtract next expenses:

- financing desire costs

- human anatomy corporate costs

- land tax

- state government and you may h2o cost

- garden and you may assets fix

- cost of advertisements to own clients

On the other hand, you are able to wish to thought negative gearing, hence makes reference to if the can cost you of having a property try more than the income you will be making from it. Bad gearing produces a text losses, in the sense a struggling providers get listing a loss to your year, letting you offset it losses facing your almost every other money and you will reducing the tax you pay.

The fresh new Australian Income tax Office web site will provide you with a few more helpful information on bad gearing, together with what expenses you happen to be entitled to allege.

Controlling your home

Maintaining your property well-looked once and making certain that your own clients are happy is an important part away from dealing with forget the. You can do this on your own, otherwise employ a realtor to cope with the house or property into the your account. Diy shall be decreased, but may additionally be stressful, complex and frustrating. Below are a few of all things a landlord can help you which have: