Flagstar Financial had become 1987 and business have developed into one of the biggest mortgage originators in the united kingdom. While you are Flagstar Bank’s branch system is limited so you can four claims Michigan, Indiana, Ca, Ohio and you can Wisconsin the company’s lending organization possess a wider private exposure which have 79 lending towns and cities in the twenty eight states.

Flagstar Lender: Instantly

Flagstar Bank’s home collateral financing goods are most suitable for individuals who already analysis banking at place, since the bank also provides an auto-pay discount. That isn’t advisable if you live in the Tx, once the bank’s family security situations are not available there.

No household equity financial is the best. If you are considering using Flagstar Bank to gain access to a few of their domestic collateral, examine these major positives and negatives before you apply.

everything we such as

- Extra coupons options: Also provides a benefit for starting automated payments of a good Flagstar account (0.5% disregard towards the HELOCs and you may 0.25% discount towards house security financing).

- Highest gang of financing number available: $10,100 so you’re able to $1 million.

- No extra settlement costs: Zero bank-imposed closing costs for household guarantee finance.

Whatever you can’t stand

- Restricted availableness: House security funds are just readily available using an actual physical merchandising venue.

- Short-term details: Limited pointers available online in the borrower’s criteria.

- The fresh discount option is maybe not for everyone: The low HELOC introductory interest rate is only readily available for fund away from $50,000 or maybe more.

House security device options

If you find yourself currently a good Flagstar Bank customer which have a bank account, you could build automatic payment to obtain an economy towards the the bundle. On two breakdowns less than, the brand new Annual percentage rate number range from the disregard.

Family security personal line of credit: Flagstar Bank’s HELOC will give you the flexibility to obtain as frequently currency as you need, as it’s needed, and also you shell out a variable interest rate ranging from six.99% and you will 21% once a six-times marketing rates of five.49%. Loan wide variety try versatile and you may start around as little as $ten,100000 so you’re able to $one million. For people who acquire more $five hundred,100000, you ought to shell out term insurance policies toward bank.

As long as you hold the membership discover for around three-years, you will not shell out any closure will set you back. Yet not, adopting the first year, you only pay a charge out of $75 every year.

Home loans: After you submit an application for a property collateral financing out-of Flagstar Lender, you get an amount of cash and possess about three alternatives for paying it: 10-seasons, 15-seasons, and you will 20-season terminology. You can use from around $10,000 in order to $one million provided you continue a combined loan-to-worth proportion from 80% otherwise quicker.

There are not any deal fees if you keep account discover for around 36 months. Flagstar Lender charges a good $75 yearly commission to own HELOCs, however, waives the initial 12 months. For people who use over $five-hundred,one hundred thousand, you should pay money for this new lender’s label insurance coverage.

Charges away, you will need to seriously consider the fresh Apr for the Flagstar Financial lending options. For the a beneficial HELOC, the lending company charges ranging from 6.99% and you can 21%, depending on the credit score. Family equity fund possess a fixed interest rate of seven.79% – more than half a time greater than the common cost to your Bankrate, CNET’s sibling website. Although not, there aren’t any closing costs.

How-to be considered

When you are Flagstar Bank cannot divulge specific creditworthiness requirements for its domestic security mortgage things, there are a few crucial considerations the bank makes whenever evaluating programs. When applying for good HELOC, the property have to be sometimes a-1- in order to cuatro-product holder-filled building or a-1-equipment next home, along with your joint mortgage-to-worth ratio cannot surpass % for the the newest credit line connected to your current home loan could be extra.

For individuals who get a home loan, it ought to be your primary home (second homes commonly acceptance) together with combined mortgage-to-worthy of ratio don’t meet or exceed 80% along with your current mortgage.

Become

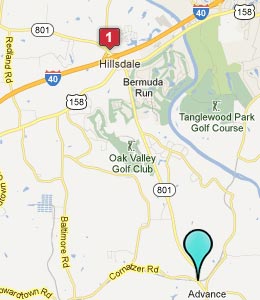

How you can find out if your be eligible for one of Flagstar Bank’s home security mortgage possibilities same day personal loan is to let the company’s web site to use your place. Based on your zip code, the lending company allow you to know if you might make an application for a great HELOC and household collateral loan. HELOCs are all, but household security fund are a lot significantly more restricted.

You could start your application on line. In the event you, you’ll need to share some factual statements about the priount, the remaining equilibrium, their fees and payment per month – together with your license recommendations and you can details about a profit. If you don’t should start on the web, you can name 888-686-1454 to talk to financing advisor.

Customer care

While you are Flagstar Financial also provides a convenient on the web software, there are a selection from an approach to connect with a genuine person. You could potentially phone call 888-686-1454 for connecting which have a card specialist over the telephone. Agencies are available Tuesday thanks to Friday anywhere between 7:29 have always been Eastern Some time and Saturday anywhere between eight:31 was and you can cuatro:00 pm. If you take out that loan from the financial and need advice about your payments, the organization possess a good twenty four-hour mortgage provider matter: 800-968-7700.